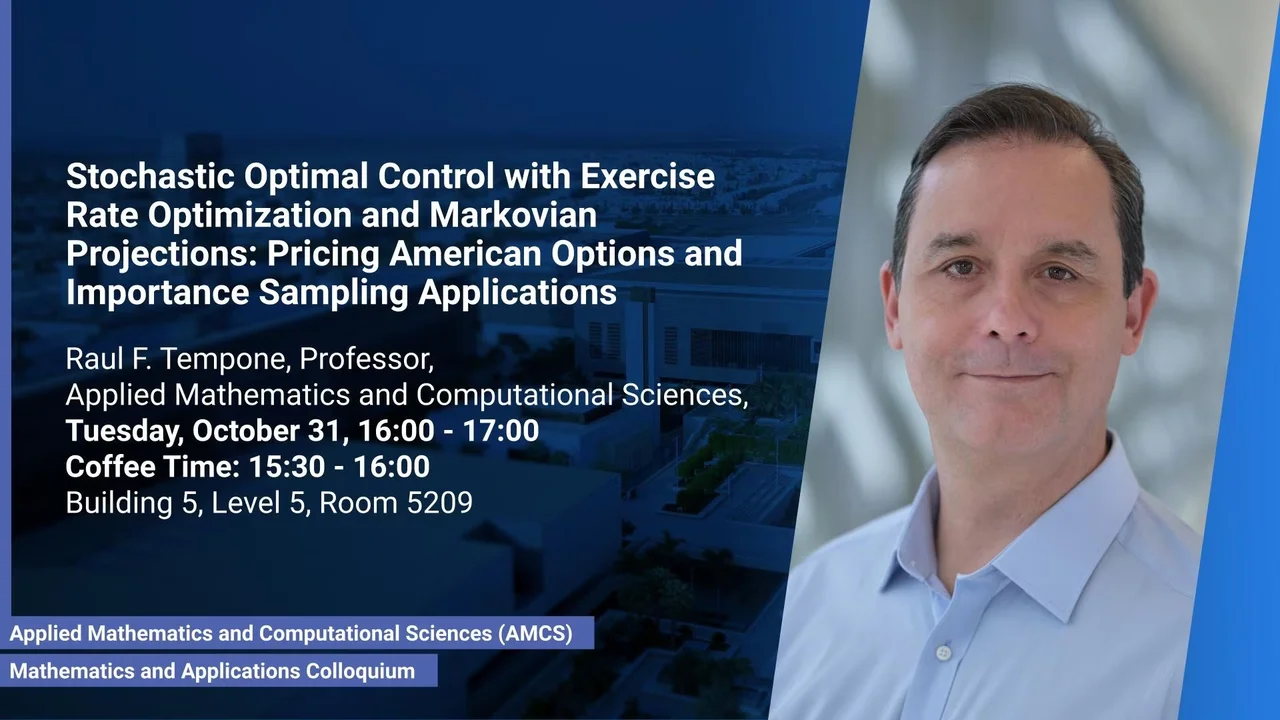

Stochastic Optimal Control with Exercise Rate Optimization and Markovian Projections: Pricing American Options and Importance Sampling Applications

This talk begins with the problem of pricing American basket options in a multivariate setting. In high dimensions, nonlinear PDE methods for solving the corresponding Hamilton-Jacobi-Bellman (HJB) equation become expensive due to the curse of dimensionality.

Overview

Abstract

This talk begins with the problem of pricing American basket options in a multivariate setting. In high dimensions, nonlinear PDE methods for solving the corresponding Hamilton-Jacobi-Bellman (HJB) equation become expensive due to the curse of dimensionality. In the first part, we present a novel method [1] for the numerical pricing of American options based on Monte Carlo Simulation and the optimization of exercise strategies. Previous solutions to this problem either explicitly or implicitly determine so-called optimal exercise regions, which consist of points in time and space at which a given option is exercised. In contrast, our method determines the exercise rates of randomized exercise strategies. We show that the supremum of the corresponding stochastic optimization problem provides the correct option price. By integrating analytically over the random exercise decision, we obtain an objective function that is differentiable with respect to perturbations of the exercise rate, even for finitely many sample paths. The global optimum of this function can be approached gradually when starting from a constant exercise rate. Natural parameters for discretization are the number of time-discretization steps and the required degrees of freedom in the parametrization of the exercise rates. Numerical experiments on vanilla put options in the multivariate Black--Scholes model, and a preliminary theoretical analysis underline the efficiency of our method. Finally, we demonstrate the flexibility of our method through numerical experiments on max call options in the classical Black--Scholes model and vanilla put options in both the Heston model and the non-Markovian rough Bergomi model.

In the second part of the presentation, we propose to use a stopping rule that depends on the dynamics of a low-dimensional Markovian projection of the given basket of assets [2]. It is shown that the ability to approximate the original value function by a lower-dimensional approximation is a feature of the system's dynamics and is unaffected by the path-dependent nature of the American basket option. Assuming that we know the density of the forward process and using the Laplace approximation, we first efficiently evaluate the diffusion coefficient corresponding to the low-dimensional Markovian projection of the basket. Then, we approximate the optimal early-exercise boundary of the option by solving an HJB partial differential equation in the projected, low-dimensional space. The resulting near-optimal early-exercise boundary is used to produce an exercise strategy for the high-dimensional option, thereby providing a lower bound for the price of the American basket option. A corresponding upper bound is also provided. These bounds allow us to assess the accuracy of the proposed pricing method. Indeed, our approximate early-exercise strategy provides a straightforward lower bound for the American basket option price. Following a duality argument due to Rogers [3], we derive a corresponding upper bound solving only the low-dimensional optimal control problem. Numerically, we show the method's feasibility using baskets with dimensions up to fifty. In these examples, the resulting option price relative errors are only a few percent. In the last part of the presentation, we will discuss briefly Importance Sampling based on Stochastic Optimal Control techniques. We will discuss two cases, namely i) Stochastic reaction networks (SRNs) [4] and ii) McKean Vlasov Equations [5] Our numerical experiments verify that the proposed Importance Sampling substantially reduces the Monte Carlo estimator's variance, resulting in a lower computational cost in the rare event regime than standard Monte Carlo estimators.

Brief Biography

Professor Raul Fidel Tempone is an internationally known expert in Numerical Analysis and Uncertainty Quantification (UQ). In KAUST, Professor Tempone has established the Stochastics Numerics Research Group. The research is driven by applications from areas such as computational mechanics, quantitative finance, biological and chemical modeling, and wireless communications. More specifically, research contributions include a posteriori error approximation and related adaptive algorithms for numerical solutions of various differential equations, including ordinary differential equations, partial differential equations, and stochastic differential equations. Further research topics include Bayesian model calibration and validation, data assimilation, hierarchical and sparse approximation, optimal control, optimal experimental design, scientific machine learning, stochastic optimization, and uncertainty quantification.