Abstract

During my Ph.D. I proposed new statistical methods for modeling and inference for two specific types of time series: integer-valued data and multivariate nonstationary extreme data. We rely on the class of integer-valued autoregressive (INAR) processes for the former, proposing a novel, flexible and elegant way of modeling count phenomena. As for the latter, we are interested in the human brain and its multi-channel electroencephalogram (EEG) recordings, a natural source of extreme events. Thus, we develop new extreme value theory methods for analyzing such data, whether in modeling the conditional extremal dependence for brain connectivity or clustering extreme brain communities of EEG channels.

Regarding integer-valued time series, INAR processes are generally defined by specifying the thinning operator and either the innovations or the marginal distributions. The major limitations of such processes include difficulties deriving the marginal properties and justifying the choice of the thinning operator. To overcome these drawbacks, this dissertation proposes a novel approach to building an INAR model that offers the flexibility to prespecify both marginal and innovation distributions. Thus, the advantage is that the thinning operator is no longer subjectively selected but is rather a direct consequence of the marginal and innovation distributions specified by the modeler. Novel INAR processes are introduced following this perspective; these processes include a model with geometric marginal and innovation distributions (Geo-INAR) and models with bounded innovations. We explore the Geo-INAR model, which is a natural alternative to the classical Poisson INAR model. The Geo-INAR process has interesting stochastic properties, such as MA(∞) representation, time reversibility, and closed forms for the h-th-order transition probabilities, which enables a natural framework to perform coherent forecasting.

In the front of multivariate nonstationary extreme data, the focus lies on multi-channel epilepsy data. Epilepsy is a chronic neurological disorder affecting more than 50 million people globally. An epileptic seizure acts like a temporary shock to the neuronal system, disrupting normal electrical activity in the brain. Epilepsy is frequently diagnosed with EEGs. Current statistical approaches for analyzing EEGs use spectral and coherence analysis, which do not focus on extreme behavior in EEGs (such as bursts in amplitude), neglecting that neuronal oscillations exhibit non-Gaussian heavy-tailed probability distributions. To overcome this limitation, this dissertation proposes new approaches to characterize brain connectivity based on extremal features of EEG signals. Two extreme-valued methods to study alterations in the brain network are proposed.

One method is Conex-Connect, a pioneering approach linking the extreme amplitudes of a reference EEG channel with the other channels in the brain network. The other method is Club Exco, which clusters multi-channel EEG data based on a spherical k-means procedure applied to the "pseudo-angles," derived from extreme amplitudes of EEG signals. Both methods provide new insights into how the brain network organizes itself during an extreme event, such as an epileptic seizure, in contrast to a baseline state.

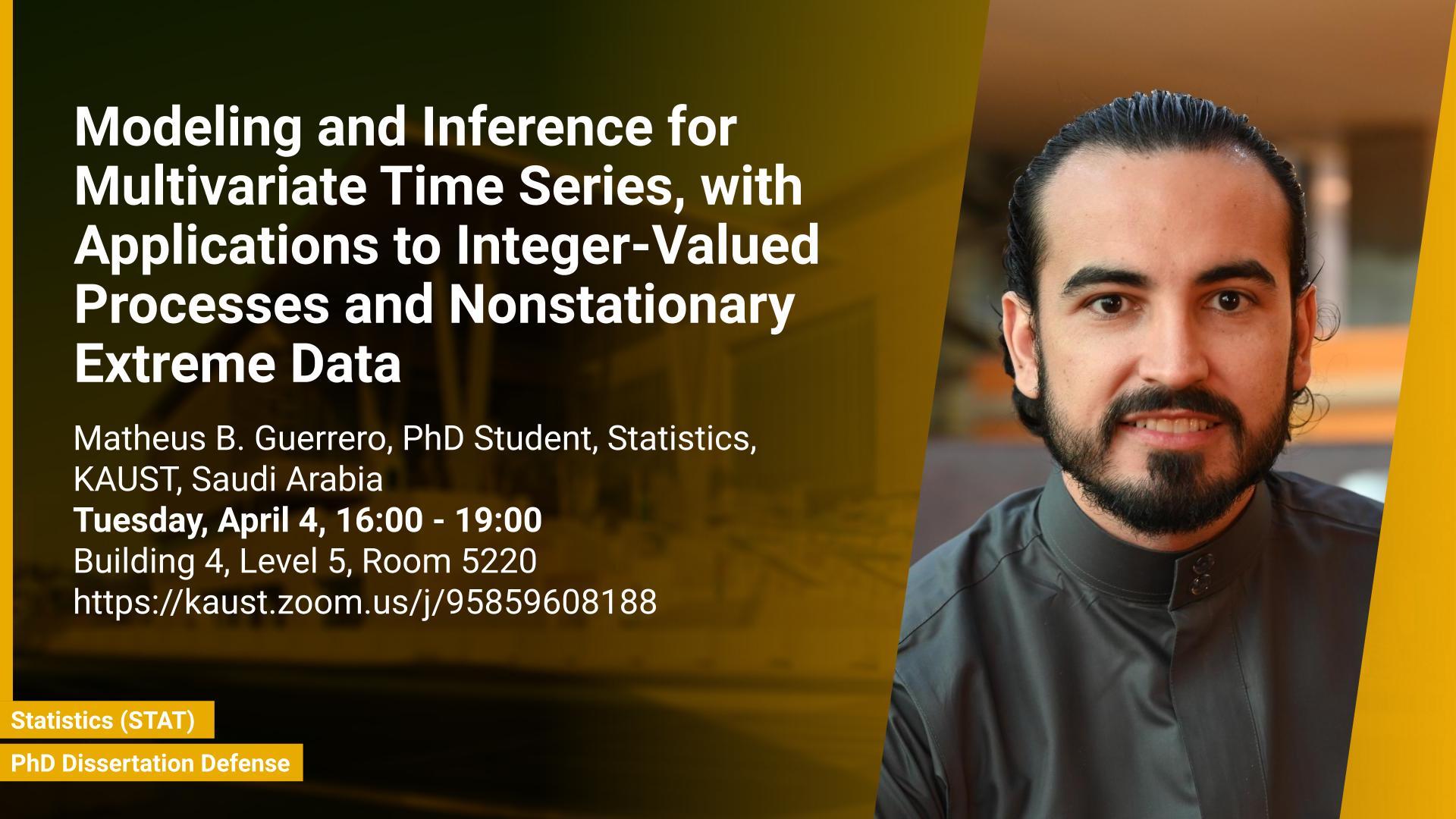

Brief Biography

Matheus Guerrero is a Ph.D. Candidate in Statistics at the King Abdullah University of Science and Technology (KAUST). His research bridges time series and extreme value theory with applications in neuroscience and finance. Matheus earned his B.S. degrees in Mathematics and Statistics from the Universidade Federal de Uberlândia, Brazil. He earned his M.S. degree in Statistics from the Universidade Federal de Minas Gerais, Brazil, in 2018. Matheus has a broad experience in finance. In 2012, he was awarded a scholarship by the Banco do Brasil to study at the Universidade do Minho, Portugal. From 2010 to 2015, he worked as a pricing analyst in the Treasury Department of Banco Triângulo; a financial conglomerate specialized in providing funding and financial services for the entire Brazilian retail chain. At KAUST, he expanded his experience on time series applications by developing realistic statistical models for brain connectivity in the presence of shocks and extreme behavior.